Comprehensive Guide to One-time Social Insurance claim for Foreigners

Making a One-time Social Insurnace Claim for Foreigner Individuals with INTERTAX.

Find out how to calculate your claim, how we deal with claims , and what you need to know.

Important thing you should know

The below is a guide only. We may need other documents in order to accurately process your claim.

For more details, please call us at +84 904912427. Or you can send us an email via info@intertax.vn

How is the One-Time Social Insurance Claim for foreign workers calculated?

Application process for One-Time Social Insurance Claim for foreigner individuals?

What are the benefits for foreigner individuals participating in Social Insurance?

What are the requirements for foreign workers to contribute to social insurance?

What is Social Insurance Contribution Rate?

How is the One-Time Social Insurance Payment for foreign workers calculated?

Clause 7, Article 9 of Decree 143/2018/ND-CP outlines the methodology for determining the rate of the one-time Social Insurance benefits for foreign workers. The formula for calculating the one-time Social Insurance payment for foreign employees is as follows:

One-time Social Insurance payment = 2 x Average monthly salary on which Social Insurance premiums are based x Number of years of payment of Social Insurance contributions.

The yearly period of Social Insurance premiums payment is rounded as follows:

- If there are odd months within a range of 1 to 6 months, the period is rounded up to half a year.

- If there are odd months within a range of 7 to 11 months, it is counted as a full year.

Application process for One-Time Social Insurance Claim for foreigner individuals?

Foreign workers ending contracts or with expiring work permits, certificates, or licenses can apply for One-Time Social Insurance Payment within 10 days from termination.

Within a maximum of 5 working days after receiving it, the department will review the application and ensure that all necessary documents are included.

Once the processing is complete, the Social Insurance Department will provide settlement results to the foreign employee. This includes two aspects:

- Relevant documents: can be obtained directly from the Social Insurance department, through the public postal service, or via electronic transactions.

- Payment subsidy: can be received directly at the social insurance agency, through the public postal service, via a personal bank account.

If the foreign employee designates another individual to receive the payment on their behalf, they are requested to follow the “authorization to receive social insurance and unemployment benefits” procedure, including the original mandated contract.

What are the benefits for Foreign Individuals Participating in Social Insurance?

Clause 1, Article 5 of Decree 143/2018/ND-CP outlines the mandatory Social Insurance provisions applicable to foreign workers, encompassing the following aspects:

- Employees specified in Clause 1, Article 2 of this Decree are entitled to benefit from the following compulsory Social Insurance regimes: sickness, maternity, occupational accident and occupational disease insurance, retirement and death.

- Clause 6, Article 9 of Decree No 143/2018/NĐ-CP stipulates that from January 1st, 2022, foreign employees working in Vietnam and participating in compulsory Social Insurance can withdraw the one-off amount of Social Insurance allowance if they wish to do so.

Foreign individuals can opt to withdraw the Social Insurance allowance under the following circumstances:

- Upon reaching the retirement age and having made Social Insurance premium payments for a minimum of 20 years, or if they no longer reside in Vietnam

- In the event of being afflicted with a life-threatening disease as defined by the Ministry of Health; and

- Upon the termination of their labor contract and/or expiration of the practicing certificate or practicing license, without the possibility of renewal.

What are the criteria for social insurance contribution for foreign workers?

Eligibility conditions for foreign employees to join the mandatory social insurance scheme in Vietnam are as outlined below:

Foreign individuals employed in Vietnam are obligated to partake in the compulsory social insurance program if they meet the following criteria:

- They possess work permits, practicing certificates, or practicing licenses issued within Vietnam.

- They hold indefinite-term employment contracts or employment agreements that are valid for a minimum of one year with employers situated in Vietnam.

However, this requirement does not apply to:

- Foreign workers who are intra-company transferees, as defined in clause 1 of Article 3 of Government Decree No. 11/2016/ND-CP dated February 3rd, 2016, which provides specific guidelines related to certain aspects of the Labor Code concerning foreign employees employed in Vietnam

- Employees who have reached the retirement age specified in clause 1 of the Article 187 of the Labor Code:

- For males, the retirement age is 60 years and 3 months if retiring in 2021.

- For females, the reirement age is 55 years and 4 months if retiring in 2021.

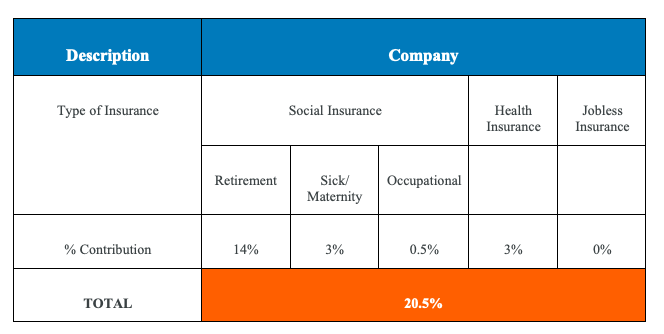

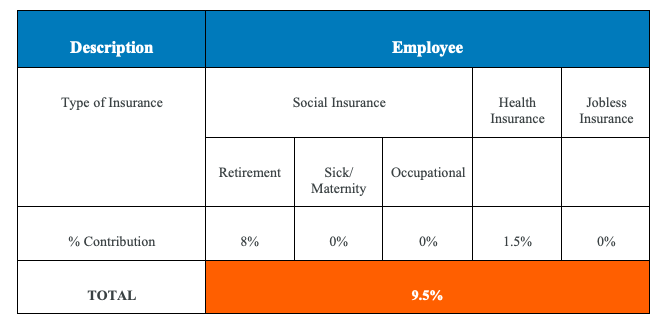

What are the social insurance contribution rate for foreign workers?

Social Insurance Contribution Rate:

Starting from January 1st, 2022, foreign workers are mandated to allocate 8% of their monthly salary towards Social Insurance contributions. This sum is directed into the retirement and death benefit fund. The specific amount to be contributed is determined based on the individual’s monthly wage or salary.

It’s important to note that the contribution amounts will vary according to each employee’s earnings. However, there exists an upper limit on the salary that is used for the calculation of contributions.

This upper limit is set at 20 times the standard minimum wage designated for social and health insurance, which currently stands at VND 36 million (equivalent to US$1,527.27), and 20 times the regional minimum wage for unemployment insurance.

The salary that is subject to the social insurance contribution is defined in accordance with the terms of the employment contract.

Nonetheless, this amount is capped at 20 times the government’s stipulated minimum salary for social insurance contributions.

Để xem bài viết bằng Tiếng Việt, click tại đây.

Not sure where to begin?

Schedule a free 30-minute consultation

Quynh Tran (Quinn) / Manager – Clients, Partners and Operations

We can talk online on Google Meet or meet you in our office in HCMC